The other week I came into a couple hundred bucks, cash. I don’t typically have dollar bills in my wallet, but I’m old enough to remember when that was the norm—a handful of coins jangling around, actually handing someone a tip, even making change behind the register. Sure, it still happens, but it all sounds pretty antiquated.

So I’ve been spending the $$$, except when I can’t.

The other night I tried a new pasta place in town: walking in not to be greeted by a person but a screen on the wall. On the screen I placed my order, paid (+ tip), and in a few minutes had the food delivered without so much as a pleasantry. And I had to ask myself, is this really what we’re after?

It’s no news that we basically have a cashless society. If we’re not swiping plastic, it’s scanning QR codes. We take this sort of progress for granted—the inevitable evolution of a society obsessed with efficiency and convenience—but do we want an efficiency so complete that human connection itself becomes an inconvenience?

In spite of ourselves, I think the answer is no.

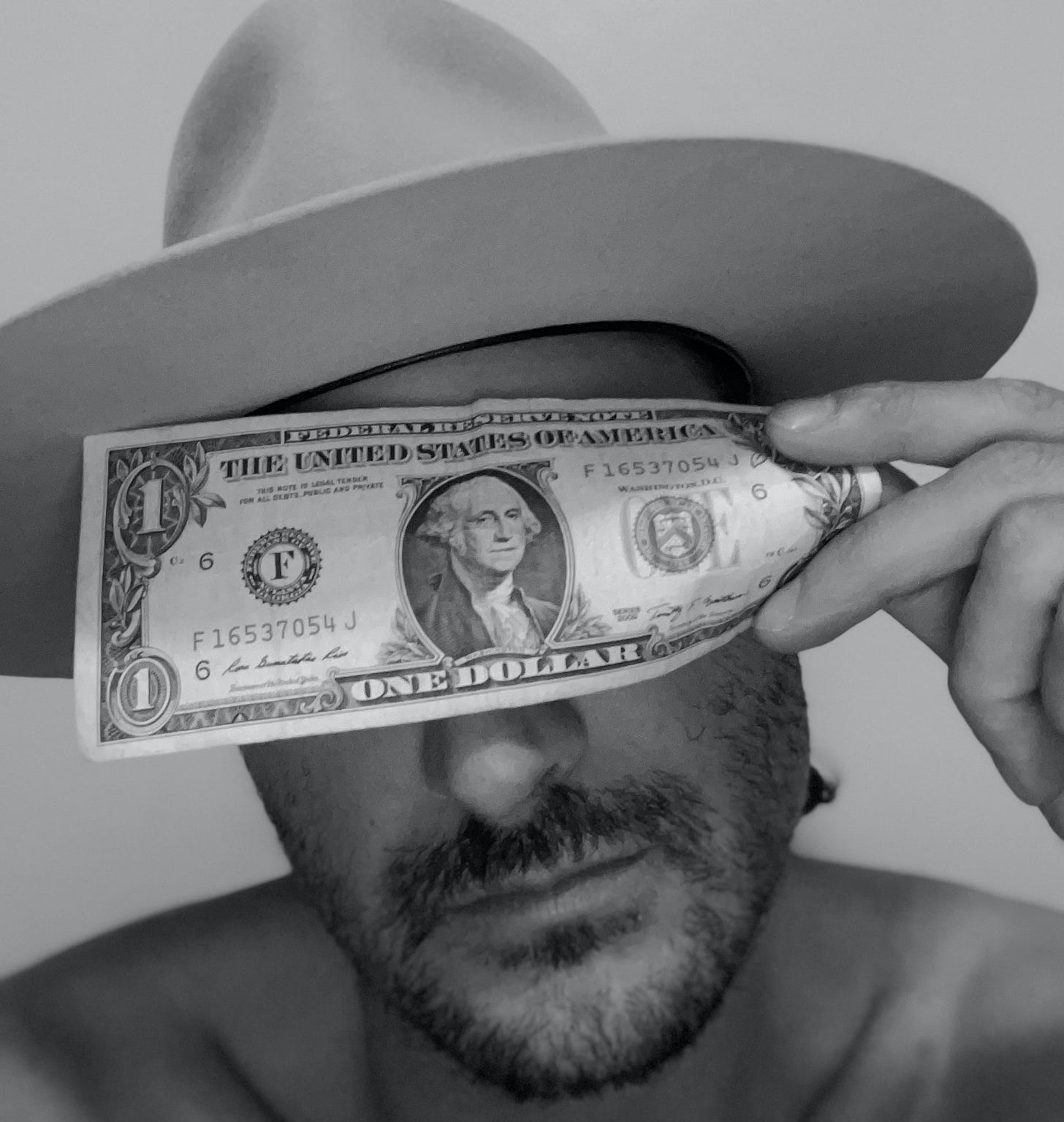

It’s sort of become a project to prove this whilst spending my cash. Every time I hand it over, I feel like I’m putting the action back the transaction and the interaction, which goes from anonymous to personal. There’s an actual exchange of goods and services. And it’s way more satisfying to drop a few bucks in the tip jar than to select that box on the screen. In those extra few seconds when the cashier makes change, maybe we even have a little conversation.

Sidebar: studies have shown that the key to longevity is in our social connections, not just with friends and family, but in these passing conversations, too.

The rising anonymity in our financial transactions is predicated upon abstraction. For thousands of years money existed in the physical realm—first in the form of coinage and later fiat currency—now our cashless society has debased the value of these interactions, reducing them to figures in a digital ledger book, out of sight and out of mind.

The tangibility of cash mitigates the modern loss of personal connection. But it also helps us financially, too.

We’ve been conditioned inside this society to consume. Consumption feels good. Why else is it so satisfying to get that box in the mail? Or to finish the last of the orange juice and throw the carton away? We’re taught that products are meant to be consumed: we receive that potential energy upon purchase and that kinetic energy with use.

Good citizens, so we’re told, need more, more, more. And a cashless society promotes that ideology more than one which uses tangible currency, exactly because cash is the more satisfying way to pay. You can literally feel it being spent. On the other hand, swiping plastic for a $10 and $1,000 charge take the same amount of effort, which both obscures the amount of money going out and reduces the satisfaction of consumption, thereby making us do it more. So although, as the phrase goes, cash burns a hole in my pocket, I actually spend it more wisely than when I use my card.

It’s almost as if with credit cards we don’t get to enjoy the fruits of our labor, or work, or what Bill Perkins calls our “life energy”: the idea that money captures much of the effort we expend while we’re alive. When we lose the tangibility of money, it’s all the more easy to forget the real-world implications of spending too much . . . that is, debt.

We’re not to blame as individuals, exactly—this is a societal problem. To illustrate: as a sophomore at the University of Colorado I went into my advisor’s office to inquire about taking a class on personal finance. She thought about it for a minute, this being a four-year federally-funded institution, and finally said, “I think you’ll have to go to a community college for that.” If that’s not fucked up, I don’t know what is. Financial literacy is non-existent in most of the educational system. And we wonder why people are so underwater.

Thankfully, people like

of Making of a Millionaire are serving up a healthy dose of financial literacy every week. If only most knew there was a problem at all.So let’s accept that the abstraction of money does not serve the individual: not from a financial perspective, and not in the way of personal connection. The solution? We must be intentional with how we spend it, in both form and in function.

For instance, don’t let convenience replace interpersonal communication (e.g. hey DoorDash, drop the food off at my front door, no contact) and instead let it foster connection. And also be sure to situate money in the larger context of our society. William S. Burroughs does this best . . .

In the end, of course, money is merely a tool. Take it from this homebuilder that tools are best used in your hands. So hit up the ATM, cash out a few twenties, and have a nice little conversation with the next cashier you see.

-Martin

I kept singing this song to myself while writing . . .

“There is a hole and I try to fill it up with money, money, money. But it gets bigger until your horse is always running, running, running”

You are WISE way beyond your years my friend!